Taxpayers in the Philippines are classified into two types: corporate or individuals. Those who fall on the individual taxpayer category, are those who are either employed (or a compensation income earner, which includes minimum wage earners) or self-employed.

Self-employed individuals are those who work on their own account or with one or few partners. In these jobs, the income is directly dependent upon the profits derived from the products or services produced by the person or individual running the business.

But there are lots of individuals who are not satisfied to being employed or self-employed alone, so they choose to be classified as “Mixed Income Earners”.

Mixed Income Earners are those with income from compensation as employee of a company at the same time having a business by providing professional services examples are registered physicians, lawyers and accountants.

For mixed income earners, the relevant provision in the TRAIN tax reform states that:

“Taxpayers earning both compensation income and income from business or practice of profession shall be subject to the following taxes:

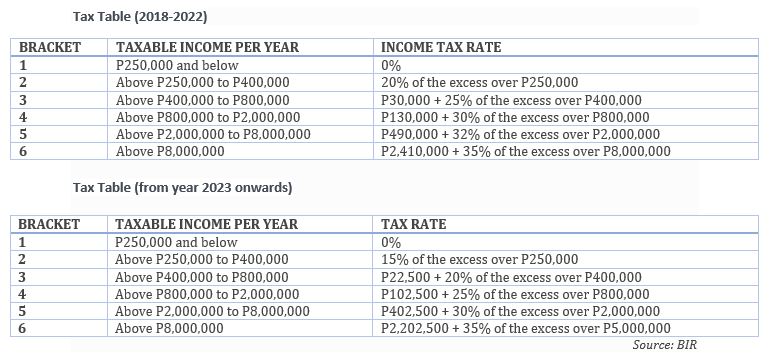

- All Income from Compensation – The rates prescribed are shown below:

- All Income from Business or Practice of Profession

If Total Gross Sales and/or Gross Receipts and Other Non-operating Income do not exceed the VAT Threshold which is Three Million Pesos (PhP 3,000,000) per year – The rates prescribed under Graduated Tax Rates, or eight percent (8%) income tax based on gross sales or gross receipts and other non-operating income in lieu of the graduated income tax rates.

However, this option is NOT AVAILABLE to the following individual taxpayers:

- VAT-registered taxpayers

- Taxpayer subject to Other Percentage Tax other than 3% OPT under Section 116.

- Partners of General Professional Partnerships (GPP)

- Individuals enjoying income tax exemption.

- Taxpayers who fail to signify their intention to avail 8% income tax rate in the First (1st) Quarter Income Tax Return or in the First (1st) Quarter Percentage tax Return, or in the initial quarterly return of the taxable year upon the commencement of a new business or practice of profession.

Also take note that Mixed Income Earners are not allowed to the Two Hundred Fifty Thousand Peso (PhP 250,000.00) deduction but only for self-employed individuals earning income purely from self-employment or practice of profession.