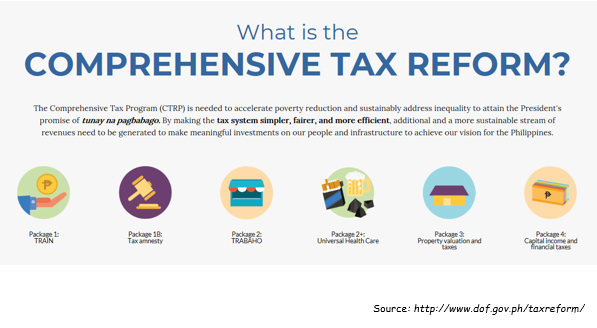

It hasn’t been that long since the first phase of the current administration’s Comprehensive Tax Reform Program(CTRP) was passed into law. The Tax Reform for Acceleration and Inclusion (TRAIN) Law or Republic Act No. 10963 was signed on December 19, 2017 and immediately took effect at the start of 2018. While everyone is busy evaluating this recently signed law, the administration is currently in the process of passing another that is bound to make more changes to the country’s tax system.

The Tax Reform for Attracting Better and Higher Quality Opportunities Bill — or the TRABAHO Bill, for short — is the second package of the Tax Reform for Acceleration and Inclusion (TRAIN) law. The bill adds and amends sections in the 21-year old National Internal Revenue Code, with the main goal of matching the country’s relatively high corporate income tax rate with those of its Southeast Asian peers. Businesses in the Philippines pay the highest corporate tax rate in the ASEAN region—30%, compared to an average 22.5% rate in our neighboring countries.

The Tax Reform for Attracting Better and Higher Quality Opportunities (TRABAHO) is focused on two things:

- Reduction of corporate income taxes.

Under TRABAHO bill, the rate will gradually reduce by 2% every two years starting 2021, eventually bringing down the current rate to 20% by 2029.

The reduction of the Philippine corporate income tax rate will enhance the country’s competitiveness and encourage more multinational companies to invest in the Philippines.

The increase in investors and companies in the Philippines will create more jobs for Filipinos and leaves more after-tax profits on the table, creating a pool of profit for possible additional compensation that companies and workers can bargain over.

- Rationalization of tax incentives

One of the most controversial features of this act is the regulation of tax incentives—perks that allow businesses to reduce their tax dues. The Philippines has more than 200 laws granting various types of tax incentives. As an example, PEZA grants an income tax holiday (ITH) of maximum of 8 years, a “perpetual” 5% tax on gross income earned (GIE), and zero value-added tax (VAT) on local purchases, among others.

Many oppose this particular feature of the bill because they know that the government is abolishing these incentives and it only aims to regulate them, setting stricter requirements. Once the changes have been implemented, only stable corporations may benefit from these awards.

The fear of layoffs will be brought to life since this change will cause harm to the investment and expansion side of businesses. Many might restructure or even worse, close their business depending on the effect of the tax incentive reduction.

Many say, “There’s always two sides of a coin.”. With that being said, the second package of the Duterte administration’s Tax Reform for Acceleration and Inclusion (TRAIN) has its own advantages and disadvantages. Let’s hope that the changes that will be brought by the Comprehensive Tax Reform Program will promote a “simpler, fairer, and more efficient tax system that is needed to promote investment, create jobs, and reduce poverty.”