With the rise of digital transformation across industries, bookkeeping is no exception. Traditional manual bookkeeping—full of spreadsheets, repetitive data entry, and lengthy reconciliations—is rapidly being replaced by AI-powered bookkeeping systems. These tools not only streamline financial operations for firms but also deliver significant cost savings, higher accuracy, faster reporting, and deeper insights.

Forward-thinking firms and outsourcing partners like XMC Asia are now at the forefront of this shift, helping businesses scale while reducing errors and overhead costs.

What Is AI-Powered Bookkeeping?

AI-powered bookkeeping refers to using artificial intelligence, machine learning, and cloud computing to:

- Automatically classify transactions

- Reconcile accounts instantly

- Detect anomalies and errors

- Generate accurate financial summaries

- Sync data across platforms in real time

Instead of manually typing, matching, and cross-checking entries, AI systems read, recognize, and act — eliminating human bottlenecks.

Why Firms Are Switching to AI-Driven Bookkeeping

Massive Cost Reductions

Traditional bookkeeping costs add up quickly:

- Manual hours

- Employee benefits

- Overtime

- External audit adjustments

AI reduces repetitive workloads, meaning firms can redirect staff to higher-value financial planning tasks.

💰 Example: If a firm spends roughly ₱50,000 monthly on bookkeeping labor and inefficiencies, automation can cut this by 40–70%, translating to hundreds of thousands of pesos saved annually.

Improved Accuracy & Error Detection

Human errors—like misclassifying expenses or overlooking duplicates—are inevitable. AI bookkeeping dramatically cuts mistakes by:

- Automatically validating entries

- Flagging unusual transactions in real time

- Providing consistent categorization

This level of data integrity helps firms avoid costly corrections and audit disputes.

Faster Reporting & Decision Support

AI tools transform bookkeeping from a historical record-keeping function into a strategic financial driver.

With real-time dashboards and automated monthly closures:

- Owners see cash positions instantly

- Forecasts update automatically

- Strategic decisions become better informed

Firms leveraging these tools report 30–50% faster close cycles versus manual methods.

Scalability Without Proportional Costs

Growing your client base traditionally requires hiring more accountants—a costly approach.

AI makes scaling efficient:

- Systems work 24/7

- No additional marginal cost per client

- Staff focus on advisory roles

This scalability is why outsourcing partners like XMC Asia combine human expertise and AI tools to serve small, mid-size, and enterprise clients effectively.

Employee Satisfaction & Focused Talent

No one enjoys repetitive data work. Removing mundane tasks:

- Increases staff morale

- Reduces burnout

- Elevates roles to strategic reporting, forecasting, and compliance

Firms adopting AI retain talent more easily because employees engage in higher-impact work.

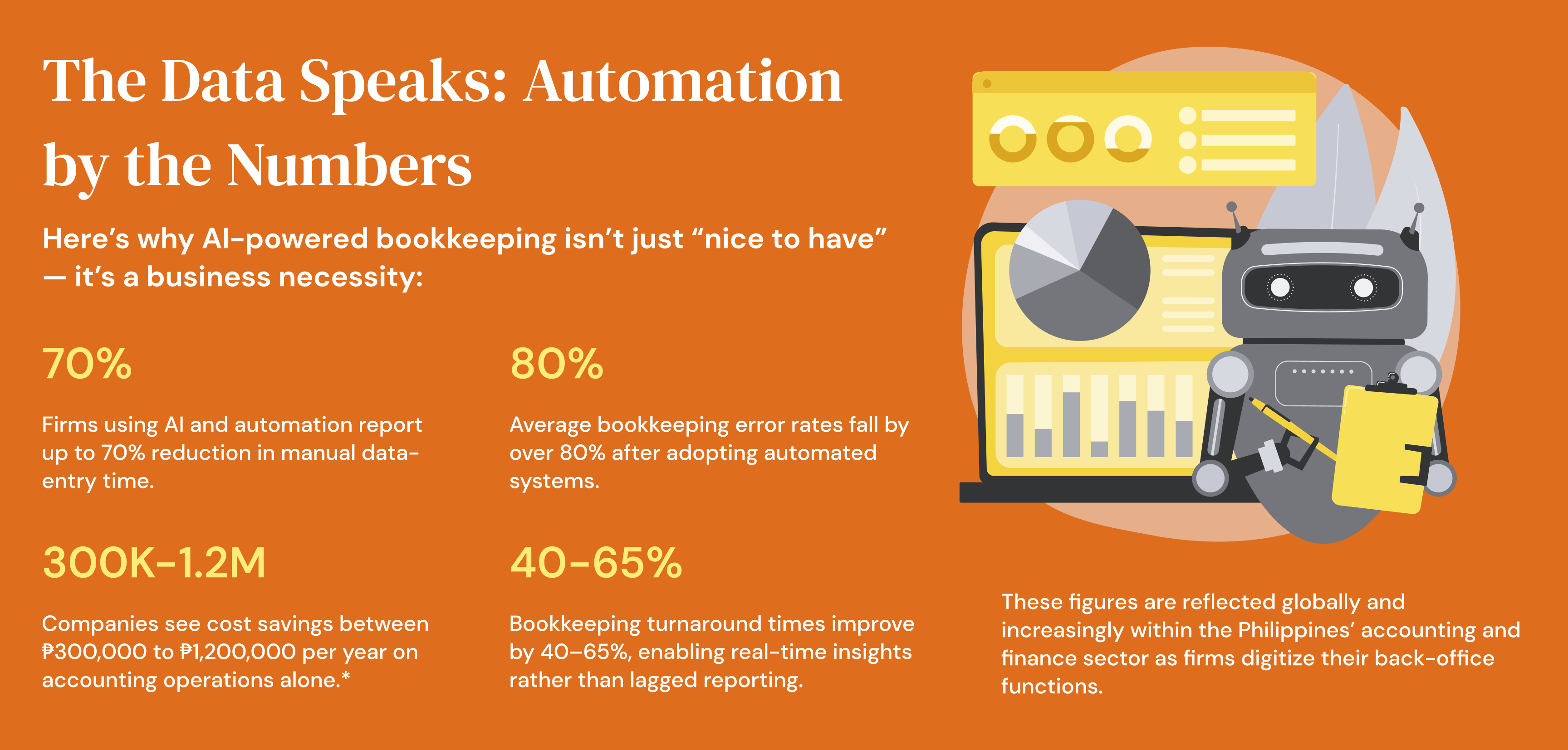

Top Benefits of AI-Powered Bookkeeping

Accuracy

Reduces errors by 80%+

Time Savings

Cuts bookkeeping hours by 50%+

Cost Efficiency

Saves ₱300,000–₱1,200,000 annually

Real-Time Insights

Immediate financial visibility

Scalability

Handles growth without added staff

Compliance

Instant audit trails and secure digital records

How XMC Asia Drives AI Bookkeeping Transformation

XMC Asia blends advanced automation with human bookkeeping expertise to deliver:

- End-to-end AI bookkeeping systems

- Cloud-based workflow platforms

- Automated reconciliation and error alerts

- Integrated reporting dashboards

- Scalable outsourcing solutions

With this hybrid model, clients achieve faster close cycles, higher data accuracy, and significant operational savings — all while freeing internal teams for more strategic finance work.

Conclusion: AI Is the Future of Bookkeeping

AI-powered bookkeeping is no longer just an emerging tool — it’s a core driver of competitive advantage for accounting firms and finance teams.

By reducing errors, slashing costs, enhancing accuracy, and enabling real-time insights, firms that adopt AI are reshaping the role of finance from simply reporting numbers to advising strategy.

And for firms looking to scale efficiently in 2025 and beyond, integrating AI tools with experienced teams — especially through partners like XMC Asia — is a smart, future-ready approach.

References

- Zipdo. AI In The Bookkeeping Industry Statistics

- Gitnux. AI In The Accounting Industry Statistics

- Oracle NetSuite. 12 Time-Saving Benefits of Automated Accounting