In today’s fast-moving digital economy, fraud and compliance risks are evolving faster than ever. Traditional methods of monitoring, detection and reporting simply can’t keep pace with sophisticated, technology-enabled schemes. That’s why more accounting, finance and professional services firms are partnering with specialists like XMC Asia — to leverage AI and embed smarter controls that match the speed and scale of modern threats.

The Changing Fraud & Compliance Landscape

Fraudsters are no longer limited to simple scams: they leverage AI, automation, cryptocurrencies, global networks and hybrid business models. Meanwhile, regulators expect firms to deliver stronger compliance, faster reporting and higher transparency. Some key dynamics:

- AI-enabled fraud: Fraud operators are increasingly using generative AI (deep-fakes, synthetic identities) to impersonate clients, bypass controls or spoof internal systems.

- Compliance burden increasing: Organizations face more regulatory demands, more data, more pressure for real-time monitoring and automated oversight.

- Legacy systems lagging: Many firms still rely on rule-based models or manual reviews; those are increasingly ineffective as fraud evolves.

In short: The combination of more sophisticated threats + heavier compliance requirements = firms must adopt new tools and approaches.

How AI Transforms Fraud Detection & Compliance

Real-Time Transaction Monitoring & Anomaly Detection

AI enables continuous monitoring of transactions, systems and behaviors: scanning thousands or millions of data points in real‐time to detect anomalies, patterns and potential fraud before damage occurs.

XMC Asia helps implement tools that integrate with accounting systems, payment platforms, remote/hybrid teams — enabling early warning systems rather than reactive detection.

Behavioural Analytics & Deep Learning Models

Rather than relying solely on rules (e.g., “transaction > X”), AI models can learn normal patterns of behaviour (employee login times, device usage, client patterns) and flag deviations that may indicate fraud or compliance risk.

XMC Asia supports firms selecting and training models, integrating them with your data architecture and aligning them with regulatory needs.

Compliance Automation & Regulatory Reporting

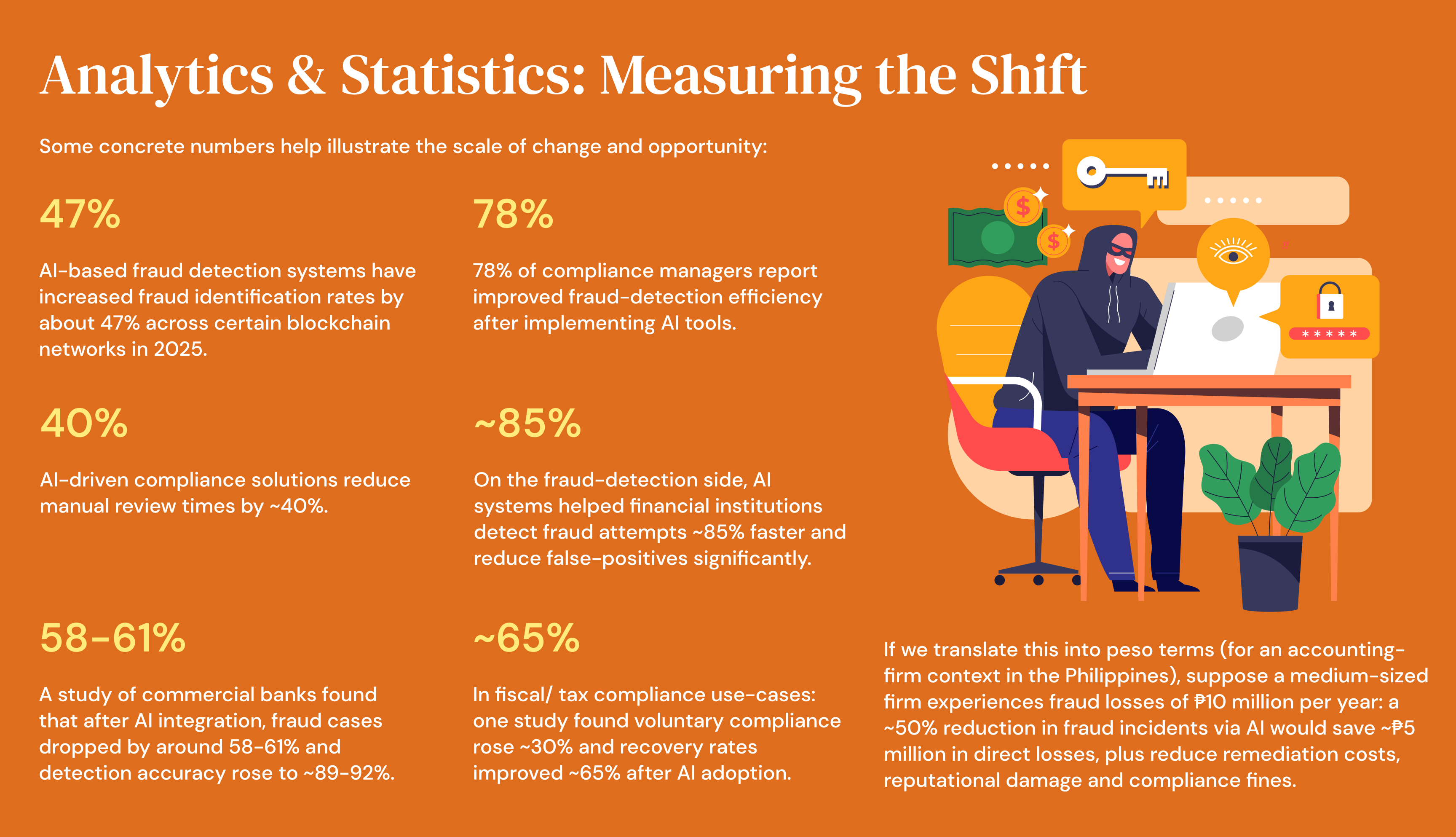

AI can automate many compliance tasks: KYC/AML checks, scheduling and consolidating reports, verifying regulatory filings, reducing manual error. For example, accuracy improvements of up to ~84% in some financial-reporting/compliance scenarios.

XMC Asia helps firms put in place the right governance, workflows and AI tools to automate compliance, freeing up teams to focus on higher-value tasks.

False-Positive Reduction & Resource Optimisation

One of the biggest burdens in fraud/compliance teams is investigating alerts which turn out to be benign (false positives). AI helps reduce false alarms, freeing staff for real investigations and reducing cost.

XMC Asia helps firms implement dashboards and performance metrics (e.g., number of alerts, resolution times, false positive rate) and thereby drive efficiency gains.

Integration of Outsourced/Remote Teams & Data Security

Given many firms use remote accounting, outsourcing or hybrid teams (including via partners like XMC Asia), AI-powered controls become even more critical: data flows across geographies, mixed teams, cloud systems. AI supports oversight, audit trails and integrity across the distributed model.

XMC Asia provides frameworks for data governance, vendor/outsourcer risk controls, and ensures your AI tools align with hybrid operating models.

Key Benefits for Firms

Reduced fraud losses

By improving detection and prevention, firms reduce direct losses, remediation costs and potentially regulatory penalties (in peso savings).

Lower operating cost for compliance

Automating routine compliance tasks saves labour cost, reduces error, and frees up teams for strategic work.

Improved client and stakeholder trust

Firms that demonstrate strong fraud/compliance controls gain credibility with clients, investors and regulators.

Enhanced agility and insights

The data from AI systems provides alerts, leading indicators and analytics, enabling firms to pivot quickly and manage emerging risks.

Competitive advantage

In the marketplace, firms that use AI-enabled fraud/compliance services (via XMC Asia) position themselves as more advanced, secure and reliable — attractive to top talent, clients and partners.

Conclusion

The adoption of AI in fraud detection and compliance isn’t optional—it’s quickly becoming essential. For accounting and finance functions, the stakes are high: fraud losses continue to rise, regulatory expectations are increasing, and the cost of failing to control risk is steep.

By partnering with XMC Asia, firms can harness AI-driven tools and frameworks that strengthen fraud detection, automate compliance, reduce false positives, and integrate seamlessly with hybrid/outsourced models. The benefits are clear: lower losses, higher efficiency, stronger trust and a future-ready operating model.

References