Artificial intelligence (AI) is transforming the accounting industry. From automated bookkeeping to predictive financial analytics, businesses are embracing AI-driven solutions to improve speed and accuracy. Yet, despite these advancements, the human role in accounting remains more vital than ever. Technology can crunch numbers, but it cannot replace the judgment, ethics, and advisory expertise that accountants bring.

Companies like XMC Asia are helping firms integrate AI without losing sight of the people who add strategic value to the profession.

The Rise of AI in Accounting

AI-driven tools now handle repetitive and time-intensive tasks such as:

- Invoice processing and accounts payable

- Data entry and reconciliations

- Fraud detection through anomaly recognition

- Tax compliance updates and filings

📊 According to Accenture, AI can improve productivity in accounting by up to 40%, freeing professionals to focus on higher-value tasks.

Why Accountants Still Matter

Human Judgment and Ethics

AI can process information but cannot apply professional skepticism or ethical judgment. Accountants ensure that financial reports remain not only accurate but also aligned with regulations and integrity standards.

Strategic Advisory

Modern accountants are business partners, offering insights into growth opportunities, risk management, and financial strategy. AI provides data, but accountants provide the context and business wisdom behind it.

Trust and Relationships

Clients trust people, not algorithms. Accountants provide reassurance, explain complex financial issues, and build long-term relationships that technology cannot replicate.

Interpreting Data for Decision-Makers

While AI highlights patterns, accountants translate them into actionable business strategies tailored to client needs.

📊 A Deloitte survey found that 79% of CFOs rely on human judgment, even when using advanced analytics tools.

Key Benefits of Balancing AI and Human Expertise

Efficiency

Automation reduces repetitive tasks, giving accountants more time for client-focused work.

Accuracy with Oversight

AI minimizes errors, while humans provide quality checks.

Deeper Insights

Accountants interpret AI-generated data to guide strategy.

Stronger Client Trust

Human interaction ensures financial advice remains personal and reliable.

Conclusion

AI is reshaping accounting, but it doesn’t diminish the role of the accountant — it elevates it. By leveraging automation, accountants can focus on delivering strategic, ethical, and relationship-driven services that machines cannot replicate.

Firms that partner with XMC Asia gain access to cutting-edge AI solutions while preserving the human expertise that truly drives business growth. In the digital age, the future of accounting isn’t AI versus humans — it’s AI and humans, working together.

References

- Thomson Reuters. How do different accounting firms use AI?

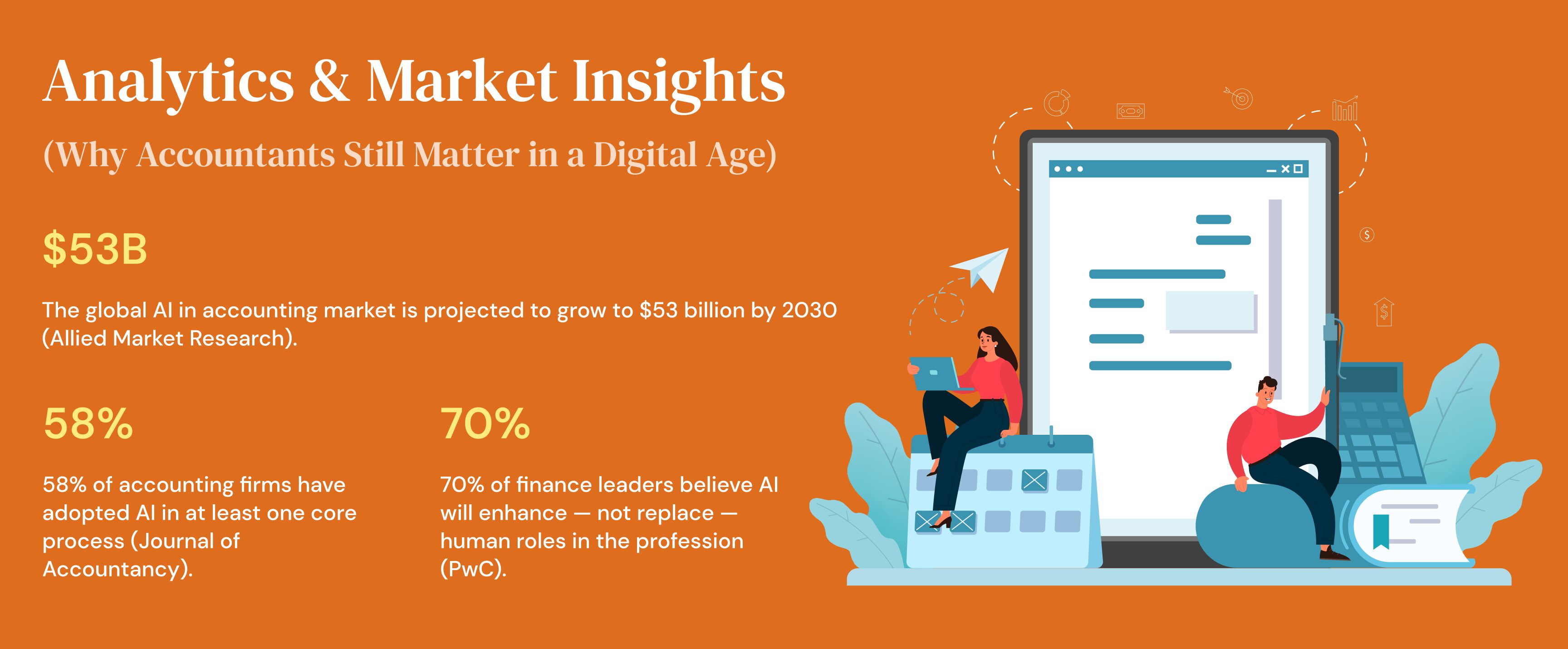

- Allied Market Research. How Can Adopting AI in Accounting Services Increase Your Business Capabilities?

- Allied Market Research. Cloud Accounting Software Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type (Browser-Based, SaaS, Application Service Providers (ASPs)) , by Enterprise Size (Large Enterprise, SMEs) : Global Opportunity Analysis and Industry Forecast, 2024 – 2032

- Global FPO. The Impact of Artificial Intelligence on Accounting Firms

- Emerj. AI in the Accounting Big Four – Comparing Deloitte, PwC, KPMG, and EY