As technology evolves, so do client expectations. In 2026, businesses don’t want just accurate books — they want fast, transparent, accessible, and strategic accounting services. Cloud accounting is no longer a trend; it’s become a core differentiator for firms looking to elevate client experience.

Accounting firms that embrace cloud technology — especially those working with forward-thinking partners like XMC Asia — are delivering better service quality, faster reporting, stronger collaboration, and deeper strategic insights.

What Is Cloud Accounting?

Cloud accounting refers to financial systems and bookkeeping tools hosted on the internet (“in the cloud”) instead of on local servers. This enables:

- Anywhere access to books and reports

- Automatic backups and improved security

- Real-time data updates

- Seamless collaboration between firms and clients

- Integration with other business platforms

Why Cloud Accounting Boosts Client Experience

Real-Time Access and Transparency

Cloud systems let clients see their financial data anytime, anywhere — with no waiting for monthly reports or emailed spreadsheets.

Clients appreciate:

- Live dashboards

- Real-time cash flow visibility

- Instant notifications of changes

- Up-to-date expense and revenue tracking

This level of transparency increases trust and speeds up decision-making.

Faster Reporting and Insights

Compared to traditional desktop software:

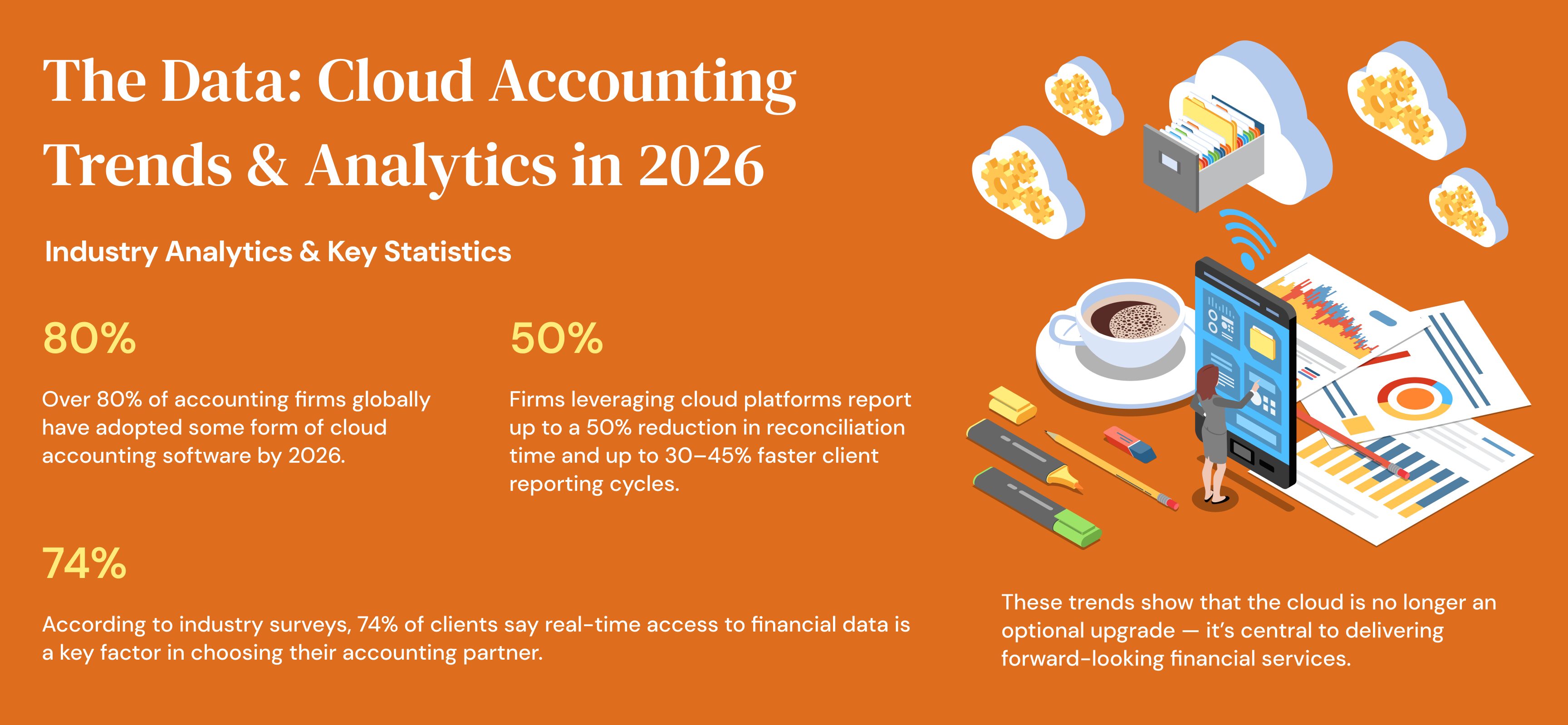

- Cloud accounting enables reports to be generated 30–45% faster

- Month-end close cycles are reduced by 25–40%

- Clients get insights before problems grow

Cloud tools cut down waiting times, allowing accountants and clients to focus on analysis rather than formatting spreadsheets.

Seamless Collaboration

Clients no longer need to send files back and forth. Cloud platforms allow:

- Shared real-time editing

- Commenting and direct messaging within reports

- Secure document storage

- Automatic version control

This reduces confusion and email overload — and helps build stronger client relationships.

Higher Security and Reliability

Cloud providers invest heavily in data protection:

- Automatic backups protect against data loss

- Encrypted connections secure sensitive information

- Multi-factor authentication (MFA) prevents unauthorized access

Clients feel safer knowing their financial data is protected and accessible only to the right people.

Integration with Other Business Tools

Cloud accounting systems often sync with:

- CRM platforms

- Payroll systems

- Expense tracking apps

- Inventory and sales systems

This connectivity means firms can offer deeper insights and more accurate forecasts — all of which improve client satisfaction.

Key Benefits of Cloud Accounting for Clients

- Real-time visibility: Clients access financial data instantly

- Faster reporting: Up to 45% reduction in turnaround time

- Greater transparency: Builds trust and improves decisions

- Smooth collaboration: Less back-and-forth, more shared insight

- Stronger security Automatic backups and encrypted access

- Strategic insights Better predictions and planning

How XMC Asia Elevates the Cloud Experience

Partnering with XMC Asia lets firms leverage cloud accounting to deliver:

- 24/7 real-time reporting to clients

- Automated workflows and updates

- Expert support for onboarding and training

- Custom dashboards tailored to client needs

- Secure, cloud-based storage and compliance

With this approach, firms can focus on advisory and growth work while XMC Asia manages the technical and operational backbone.

Conclusion: The Cloud Is a Client Experience Game-Changer

In 2026, cloud accounting isn’t just about convenience — it’s a core competitive advantage. By offering real-time access, faster insights, seamless collaboration, and better security, cloud platforms help firms deliver the level of service modern clients expect.

More importantly, cloud adoption shifts accounting from a transactional service to a strategic partnership — one where clients feel informed, involved, and empowered.

Firms that harness the power of cloud accounting — especially with proactive partners like XMC Asia — will not only keep clients satisfied but also attract new ones seeking transparency, speed, and trusted financial insights.

References

- Grow with Refrens. Boost Your Bottom Line: The Financial Benefits of Online Cloud-Based Accounting

- Accountio. 6 Ways Cloud Computing Is Reshaping Accounting Firms

- NetSuite. 15 Benefits of Cloud Accounting

- Accounting for Everyone. Cloud Accounting Benefits for Corporate Clients: Enhancing Efficiency and Accuracy