The accounting profession is evolving faster than ever. From regulatory shifts to the integration of AI and automation, Certified Public Accountants (CPAs) are facing an environment where staying updated isn’t just beneficial—it’s essential. Continuous education has become a non-negotiable part of a CPA’s career, ensuring they stay relevant, compliant, and competitive in a dynamic market.

Firms like XMC Asia are leading the charge by not only offering accounting services but also investing in continuous learning initiatives to ensure their teams and clients remain future-ready.

The Accelerating Pace of Change in the Accounting Industry

The traditional model where CPAs could rely on periodic learning to stay competent is no longer sufficient. In 2025, factors such as:

- Rapid technological disruption (AI, RPA, cloud platforms),

- Constant regulatory updates (local and international),

- Expanding advisory roles of CPAs,

…require continuous upskilling.

A Deloitte Global Survey (2025) reports that 82% of accounting professionals believe their current skillsets will be outdated within five years without ongoing education. Moreover, the AICPA mandates CPAs to complete 120 hours of continuing professional education (CPE) every three years, but leading firms now view this as a minimum standard rather than a benchmark of excellence.

Key Analytics & Statistics:

74% of accounting firms are investing in formal learning and development programs in 2025 (PwC Global Workforce Study).

CPAs who actively engage in continuous education are 37% more likely to secure senior leadership roles (Robert Half Talent Solutions 2025).

Firms offering structured upskilling programs report 45% higher employee retention and 28% improvement in client service quality (XMC Asia Internal Data 2025).

The global market for professional learning in accounting is projected to reach P12.4 billion by 2026, with a CAGR of 7.8% (Statista).

How XMC Asia Promotes Continuous Education Among CPAs

XMC Asia integrates continuous learning into its core operations. They partner with top global learning platforms and offer in-house upskilling initiatives focusing on:

- Advanced accounting technologies (AI, automation tools),

- Regulatory compliance updates (local and global standards),

- Data analytics and advisory skills,

- Soft skills enhancement (leadership, client communication).

By fostering a culture of lifelong learning, XMC Asia ensures their teams stay at the forefront of the profession, delivering unmatched expertise and value to clients.

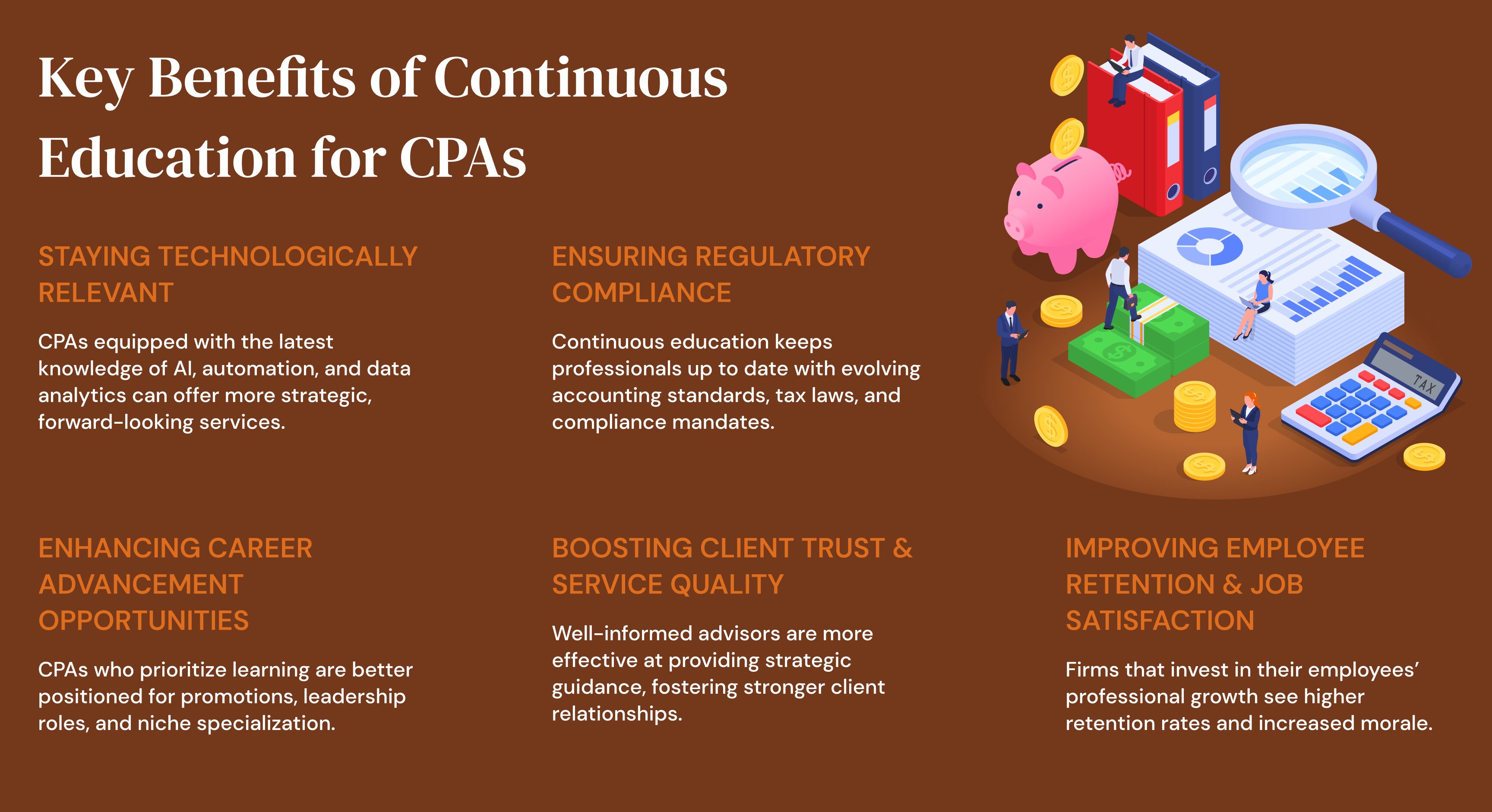

Key Benefits of Continuous Education for CPAs

Staying Technologically Relevant

CPAs equipped with the latest knowledge of AI, automation, and data analytics can offer more strategic, forward-looking services.

Ensuring Regulatory Compliance

Continuous education keeps professionals up to date with evolving accounting standards, tax laws, and compliance mandates.

Enhancing Career Advancement Opportunities

CPAs who prioritize learning are better positioned for promotions, leadership roles, and niche specialization.

Boosting Client Trust & Service Quality

Well-informed advisors are more effective at providing strategic guidance, fostering stronger client relationships.

Improving Employee Retention & Job Satisfaction

Firms that invest in their employees’ professional growth see higher retention rates and increased morale.

Conclusion

Continuous education is no longer a professional courtesy—it’s a business imperative for CPAs aiming to thrive in a rapidly changing landscape. Firms that recognize and support this need will be better equipped to adapt, innovate, and lead in the marketplace.

With XMC Asia’s proactive approach to continuous learning, CPAs gain the competitive edge needed to navigate new challenges, deliver superior client value, and build future-proof careers.

References

- Deloitte. Closing the experience gap

- LinkedIn. The Importance of Continuous Learning for Accountants

- Software Oasis. Data-Driven Analysis of Entry-Level Accountant Retention Rates and Career Progression: A Statistical Study

- Accounting Pipeline. Accounting Talent Solutions Draft Report