For decades, accounting firms were seen primarily as compliance partners—handling bookkeeping, tax preparation, and audits. But in today’s business environment, small and mid-sized businesses (SMBs) expect more than just number crunching. They want strategic insights that drive growth, optimize resources, and future-proof operations. This is why more accounting firms are now offering CFO-level advisory services, bridging the gap between traditional accounting and executive financial leadership.

The Shift in SMB Expectations

According to a 2024 QuickBooks Small Business Insights survey, 82% of SMBs said they want more advisory services from their accountants, beyond tax filing and compliance. The reason is simple: most SMBs cannot afford a full-time Chief Financial Officer, whose salary can easily reach $200,000+ per year in the U.S. Instead, they are turning to their trusted accounting partners for CFO-level insights delivered at a fraction of the cost.

This growing demand is fueling a new trend—accounting firms evolving into strategic growth advisors.

Key Analytics & Market Data

47% of SMBs fail within the first five years (U.S. Bureau of Labor Statistics), often due to poor financial planning.

Businesses with access to financial forecasting are 2.1x more likely to achieve year-over-year growth (Sage 2023).

The global outsourced CFO market is projected to grow at a 10.5% CAGR through 2030 (Grand View Research).

These numbers reflect the increasing importance of data-driven financial leadership for SMBs.

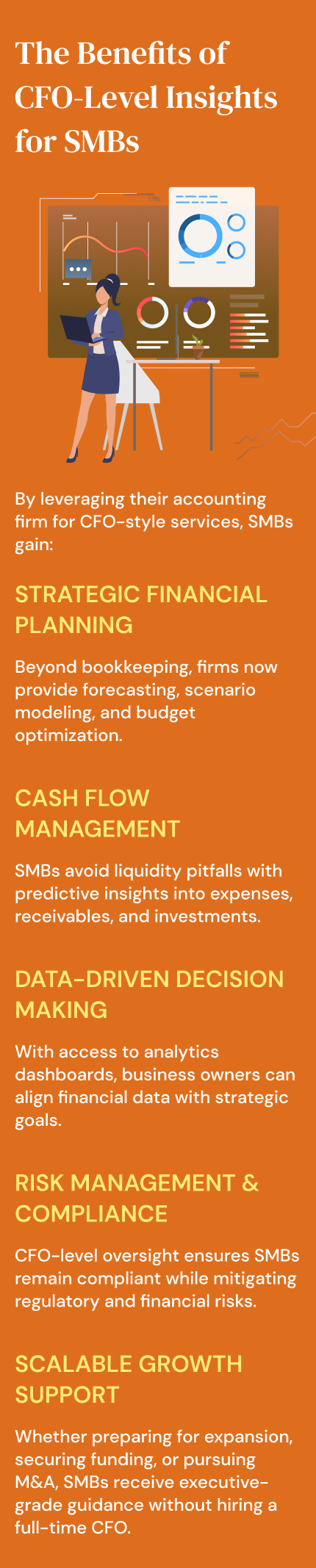

The Benefits of CFO-Level Insights for SMBs

By leveraging their accounting firm for CFO-style services, SMBs gain:

Strategic Financial Planning

Beyond bookkeeping, firms now provide forecasting, scenario modeling, and budget optimization.

Cash Flow Management

SMBs avoid liquidity pitfalls with predictive insights into expenses, receivables, and investments.

Data-Driven Decision Making

With access to analytics dashboards, business owners can align financial data with strategic goals.

Risk Management & Compliance

CFO-level oversight ensures SMBs remain compliant while mitigating regulatory and financial risks.

Scalable Growth Support

Whether preparing for expansion, securing funding, or pursuing M&A, SMBs receive executive-grade guidance without hiring a full-time CFO.

Why XMC ASIA Leads in This Evolution

At XMC ASIA, we understand that SMBs need more than reports—they need foresight. Our approach combines advanced analytics, market benchmarking, and CFO-level advisory insights tailored to the realities of small and mid-sized businesses. By bridging traditional accounting with executive strategy, we empower clients to navigate uncertainty and scale with confidence.

Conclusion

The role of accounting firms is rapidly evolving. SMBs are no longer satisfied with compliance-only services; they want strategic partners who can deliver CFO-level guidance at an accessible cost. By adopting this model, accounting firms not only meet client expectations but also unlock new revenue streams and long-term relationships.

As business challenges grow more complex in 2025, the firms that thrive will be those that act less like bookkeepers and more like CFOs—helping SMBs not just survive, but succeed.

References

- GrowthForce. Top 10 Key Benefits of Hiring an Outsourced CFO in an SME

- Nesso Group. The Importance Of Outsourced CFO Services

- Embark. Outsourced CFO Services: Benefits, Challenges, and Considerations

- Accounting Department. The Key to SMB Success: Leveraging CFO Support Services

- Verified Metrics. Why startups need outsourced CFO services