With the signing of Republic Act No. 11199 or SSS Rationalization Act, the law amended its charter and paved the way for the Social Security System (SSS) to improve its investing capacity and generate more revenue for members, Overseas Filipino Workers (OFWs) pensioners and those who involuntary left without jobs.

The newly signed law will provide a gradual increase in contributions from the current 11 percent to 15 percent by 2025. It also allows the gradual adjustment of minimum and maximum monthly salary credits. Currently, the contribution rate is at 11%. This year, a 1% increase will be implemented, one-third of which will be shouldered by the employers.

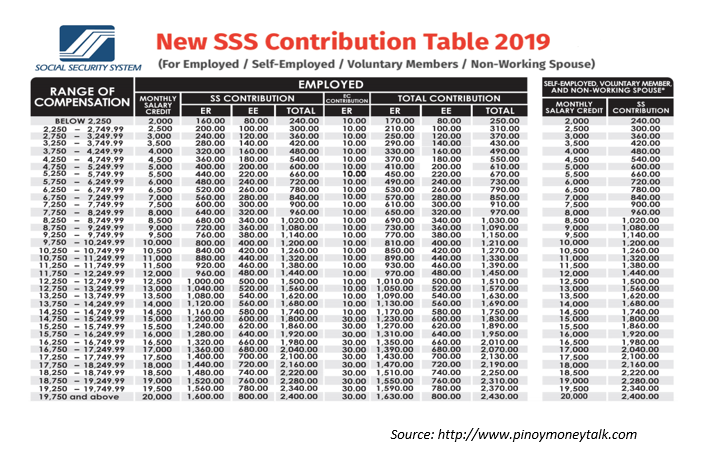

Starting April 2019, the new monthly contribution rate will be 12%, while the minimum and maximum monthly salary credits will be P2,000 and P20,000, respectively as shown in the table.

Besides the impending increase in contributions, RA 111997 will also mandate the one-time big-time amnesty for the negligent employers which can be availed without paying penalties within a six-month window period, decreasing a significant number of delinquent employer accounts. Employers are advised to take this opportunity to settle their delinquent contribution payments without penalties. The offer period will run from March 5 to September 6, 2019. The new Social Security Commission, the highest policy-making body of SSS, will also have the power to implement future condonation programs.

The law also provides for the mandatory SSS coverage of overseas Filipino workers (OFWs) to ensure their social security protection provided they are not over 60 years of age. Through the Department of Foreign Affairs (DFA) and the Department of Labor and Employment (DOLE), there will be bilateral labor agreements with OFWs’ host countries to ensure the employers pay the required SSS contributions.

Moreover, the new law will likewise include unemployment insurance for SSS members who will be involuntarily displaced. A member can get at least P10, 000 if the member had been paying the “contributions under the maximum salary credit.” However, according to Section 14-B of RA 11199, an involuntarily unemployed member can get the benefit which is equivalent to 50 percent of his average monthly salary credit for a maximum of two months

Given the said provisions, the new law empowers the commission to raise benefits, condone penalties, rationalize investments, among others.